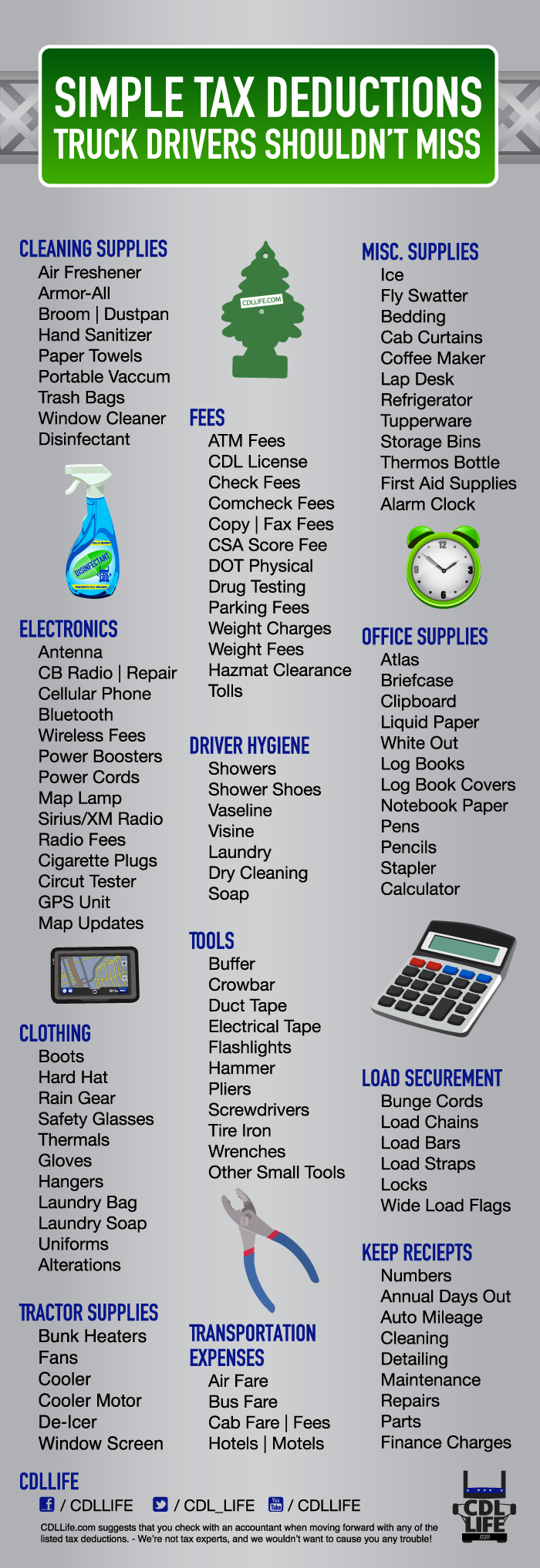

We’re less than a month away from Tax Day, and we’ve found a wonderful list of deductions you can consider. Claiming deductions helps lower your tax liability and helps you get back some of the money spent during the year for travel. Great record keeping pays off for sure! Thanks to CDL Life for compiling this list.

For more tax tips for truck drivers, check out some of these great resources!

For more tax tips for truck drivers, check out some of these great resources!

H & R Block – Great Q&A for what deductions you can and can not include.

Jackson Hewitt – Great, lengthy article about available deductions and tax laws for truck drivers.

Turbo Tax Deluxe – A few user submitted questions and answers, and a great tax software that walks you through everything you need to do if you choose to file your taxes yourself.

Are you interested in keeping better records for next year? Check out some of these great tips for staying organized!

For more information regarding the standard per diem meal allowance, please refer to the U.S. General Services Administration (GSA) website.

Here is a link to the Form 2106 instructions.

Have an great tax tips for truck drivers? We welcome you feedback!